Listen to this full acticle now

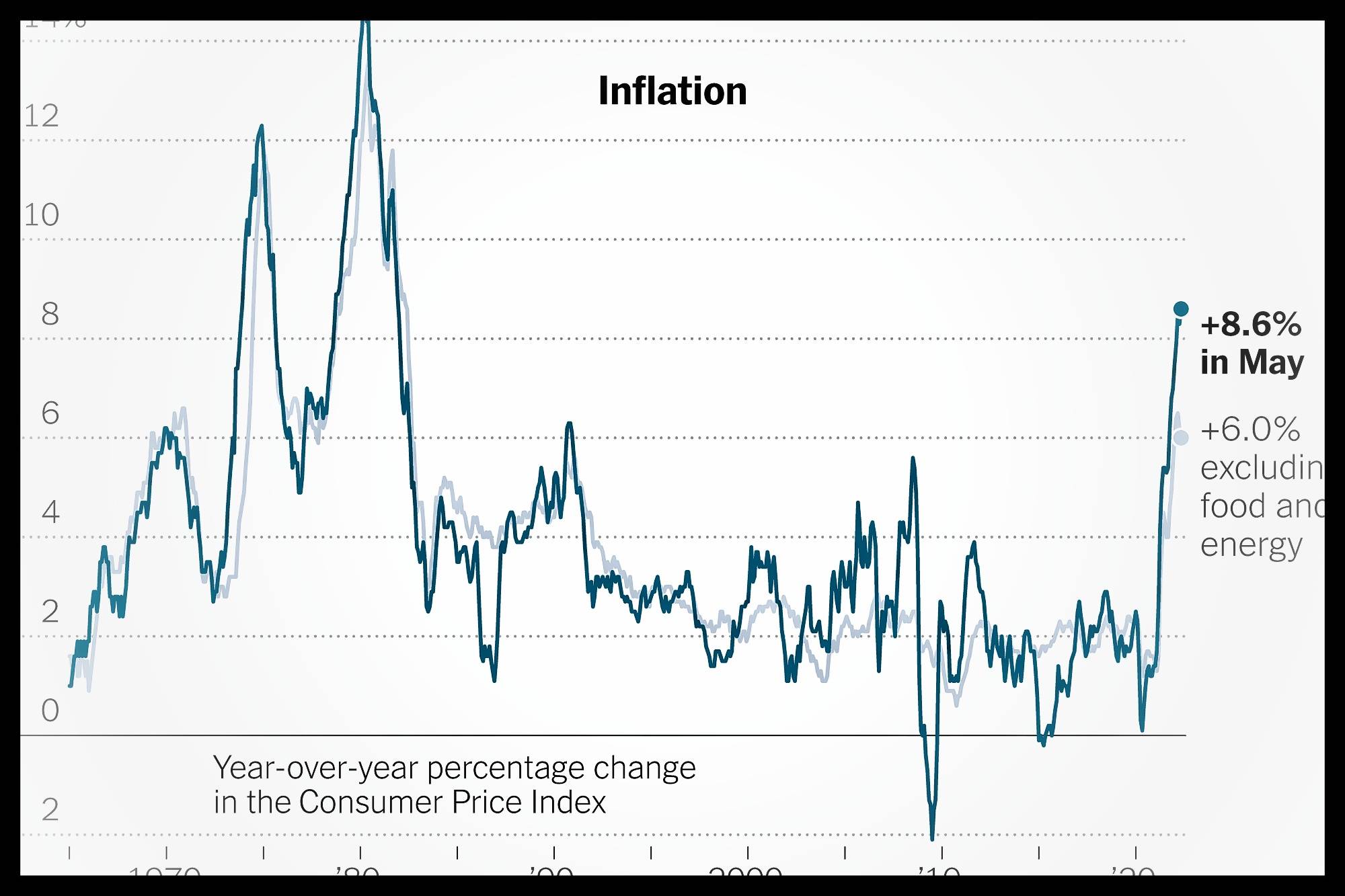

The CPI inflation report for the month of August looked essentially flat month-on-month, with prices expecting a broad 0.1% increase in prices. However, the underlying trend was more worrying for Fed policy-makers.

Lower inflation would have seen a sharp drop in gasoline prices, with most of the other major components of inflation measured by price increases.

The Fed is caring more about underlying inflation than temporary fluctuations in energy costs. And take some rest from the report.

US annual inflation stands at 8.3% since today’s report. Markets are now looking for a 100 bps hike at the end of the month, although 75 bps is the most likely outcome based on interest rate futures.

Several significant parts of the CPI index rose in August, raising concerns that underlying inflation will be higher than the Fed’s when any volatility in energy costs ceases.

Food, shelter, cars, medical costs and furniture will all see an increase in material prices for the month. This matters because today’s report is not comforting to the Fed.

There may be further rate hikes. The Fed wants to see a wide range of prices to see what the inflation wave was like in the past.

Of course this is good news of lower month-on-month rates and the falling cost of petrol is far more welcome than the reverse.

Even though the cost of food for the month saw a 0.8% increase, which is high, it is still the decline in food price inflation that we have seen several months later. Along with this, there was also a fall in airfares and prices of used cars.

However, the Fed signal originally showed that the U.S. There has been a decline in overall inflation in the U.S. and the CPI report did not offer it on most of the estimates.

Today’s report would do much to replace the Fed’s rate decision on September 21, there was a possibility but a 75 bps hike still appears to be the most likely outcome according to interest rate futures.

However, today’s report has made a 50 bps move less likely and a much larger 100 bps outlier possibility. That’s why markets believe the Fed is a little more puzzled by today’s report about where inflation has pouched.

Hence, despite the month-on-month low, today’s inflation report did not turn out to be good news for the markets. There were expectations that overall inflation, beyond gasoline prices, would moderate further.

Looks like the US Inflation is past peak inflation, but inflation still doesn’t seem to be falling as fast as some had hoped. US inflation appears to be headed in the right overall direction, but it is not in enough momentum for the Fed.